Why Knowing About Car Insurance Matters

Hey there, fellow driver! Whether you've just gotten your license or you've been cruising the roads for years, car insurance can feel like a maze of terms and numbers. But don't worry—this guide is here to break it all down for you. From the basics of Allstate car insurance to how you can save big bucks, we're going to walk you through every step. Let's make sure you're not only covered but also smart about your coverage.

Your First Auto Insurance Policy: What You Need to Know

Let's start with the basics. Getting your first car insurance policy can be nerve-wracking, but it doesn't have to be. You’ll want to think about liability coverage, collision coverage, and comprehensive coverage. Liability coverage is mandatory in most states and protects others if you're at fault in an accident. Collision coverage helps cover repairs or replacement if you crash into something, while comprehensive coverage handles non-accident-related damage like theft or natural disasters.

How to Compare Car Insurance Quotes Like a Pro

Comparing car insurance quotes can feel overwhelming, but it’s a crucial step in finding the right policy. Start by gathering quotes from multiple providers, including Allstate. Look beyond just the premium price—consider the coverage limits, deductibles, and any additional perks like roadside assistance. Remember, the cheapest policy might not always be the best fit. It's about finding the right balance between cost and protection.

Read also:Exploring The Life And Ministry Of Prophet Brian Carn

Can Young Drivers Under 25 Still Get Good Car Insurance?

Yes, absolutely! While being under 25 often means higher premiums due to perceived higher risk, there are ways to mitigate those costs. For instance, maintaining a clean driving record, taking a defensive driving course, or adding yourself to a parent's policy can all help lower your rates. Allstate offers various discounts for young drivers, so be sure to ask about those when shopping for coverage.

8 Car Insurance Discounts That Could Save You Big Time

Insurance companies like Allstate offer a variety of discounts to help you save money. Here are eight common ones:

- Good Student Discount: If you're in school and maintain a certain GPA, you could qualify for reduced rates.

- Safe Driver Discount: A clean driving record can lead to significant savings.

- Military Discount: Active duty members and veterans often receive special rates.

- Multi-Policy Discount: Bundling your home and auto insurance with the same provider can save you hundreds annually.

- Low Mileage Discount: If you don't drive much, some insurers offer reduced rates based on mileage.

- Safe Car Discount: Vehicles with advanced safety features may qualify for lower premiums.

- Paperless Billing Discount: Going green by opting for electronic billing can sometimes get you a small discount.

- Pay-in-Full Discount: Paying your entire premium upfront instead of monthly payments can lead to savings.

Car Insurance Is Mandatory Almost Everywhere

Let's talk about the law. Nearly every state requires drivers to carry some form of car insurance. The only exception? New Hampshire. But even there, financial responsibility is key. This means if you cause an accident, you're personally responsible for covering the costs. That’s why having solid insurance coverage is not just a good idea—it’s essential.

Breaking Down the Cost of Car Insurance

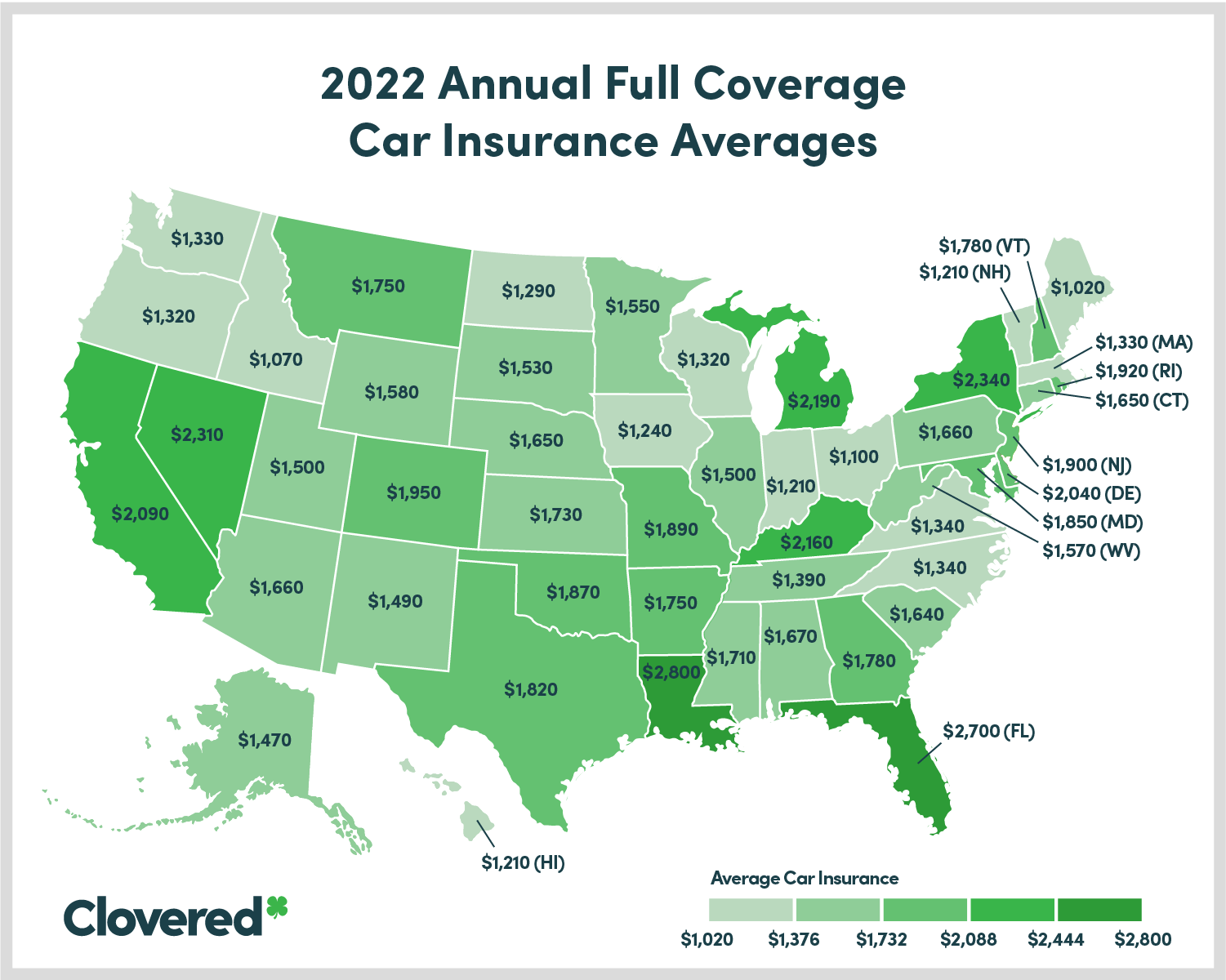

So, how much does car insurance actually cost? In 2024, the average minimum required policy runs around $693 per year. However, opting for full coverage, which includes comprehensive and collision insurance, bumps that average up to $1,630 per year. Keep in mind, though, that these numbers can vary widely depending on factors like your location, driving history, and the type of vehicle you own.

Allstate Auto Insurance: An In-Depth Look

In this section, we’re diving deep into Allstate’s auto insurance offerings. From policy types and features to customer reviews and claims processes, we’ll cover it all. Allstate is one of the largest and most reputable names in the insurance industry, known for its extensive network of agents and robust online tools. Let’s explore what makes them stand out.

Overview of Allstate Auto Insurance

Allstate offers a wide range of policies tailored to meet the needs of different drivers. Their basic liability coverage ensures you're meeting state requirements, while their optional coverages like roadside assistance and rental reimbursement provide added peace of mind. Plus, Allstate’s customer service has consistently received high marks for being responsive and helpful during claims processes.

Read also:Mothers Warmth Chapter 3 A Journey Through Maternal Love

Department of State Requirements for Employees

Interestingly, the Department of State mandates its employees to carry auto insurance with liability limits of $100,000 per person, $300,000 per accident for bodily injury, and $100,000 for property damage. This gives you an idea of the importance placed on adequate coverage, even for government workers.

Understanding the Benefits and Costs of Allstate Car Insurance

When it comes to Allstate, the benefits are clear: competitive pricing, comprehensive coverage options, and a strong support system. However, understanding the costs involves more than just looking at monthly premiums. Consider the deductibles, potential out-of-pocket expenses, and any additional fees associated with your policy. It’s all about finding the right fit for your budget and lifestyle.

Car Insurance Explained: The Ultimate Guide

Car insurance is essentially a contract between you and your insurance provider. It promises to protect you financially in case of accidents, theft, or other covered events. In exchange for paying a monthly premium, the insurer agrees to cover or reimburse you for losses as outlined in your policy. It’s a partnership designed to keep you safe and secure on the road.

Factors That Affect Your Car Insurance Rates

Several factors play into determining your car insurance rates. Your age, driving record, credit score, and where you live are all major influencers. Did you know that most states allow insurers to use credit scores as part of their rate calculations? Typically, the higher your credit score, the lower your insurance rates tend to be. Additionally, the make and model of your car, its safety features, and its likelihood of being stolen can all impact your premiums.

Smart Cars and Theft Rates

While smart cars are great for city driving and parking, they can sometimes be attractive targets for thieves. Their compact size and urban popularity mean they might carry higher theft rates, affecting your insurance premiums. Be sure to discuss this with your Allstate agent to understand how it might affect your coverage.

Tips for Lowering Your Car Insurance Costs

Who doesn’t love saving money? Here are ten practical tips to help you reduce your car insurance costs:

- Shop Around: Always compare quotes from multiple providers.

- Bundle Policies: Combine your home and auto insurance for discounts.

- Take Defensive Driving Courses: Many insurers offer discounts for completing approved courses.

- Drive Safely: A clean driving record can lead to substantial savings over time.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premiums.

- Ask About Discounts: Don’t forget to inquire about all available discounts.

- Pay in Full: Paying your entire premium upfront can sometimes result in savings.

- Use Paperless Options: Going paperless can earn you small but consistent discounts.

- Drive Less: Lower mileage can lead to lower rates.

- Review Your Policy Annually: Ensure you’re only paying for the coverage you need.

Car Insurance Costs in Ohio and Beyond

Ohio, like many states, has its own set of factors influencing car insurance costs. Urban areas tend to have higher rates due to increased traffic and theft risks. On the flip side, rural areas often see lower premiums. Your driving record and credit score also play significant roles in Ohio's rate calculations. Understanding these dynamics can help you better navigate the insurance landscape.

How Credit Scores Impact Your Rates in Ohio

In Ohio, as in most states, your credit score can significantly impact your car insurance rates. Insurers view a good credit score as indicative of responsible behavior, which translates to lower perceived risk. If your credit score isn't where you'd like it to be, focus on improving it over time to potentially lower your premiums.

That wraps up our comprehensive guide to Allstate car insurance and beyond. Remember, knowledge is power when it comes to making informed decisions about your coverage. Stay safe out there, and happy driving!